Update on 2024-05-20

There are two types of stop loss order on AscendEX: stop limit or stop market.

- A stop-loss order is a buy/sell order placed to mitigate the risk of forced liquidation or potential losses when you are worried that the market might move against your trade.

- For example, your limit buy order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop limit order to sell BTC.

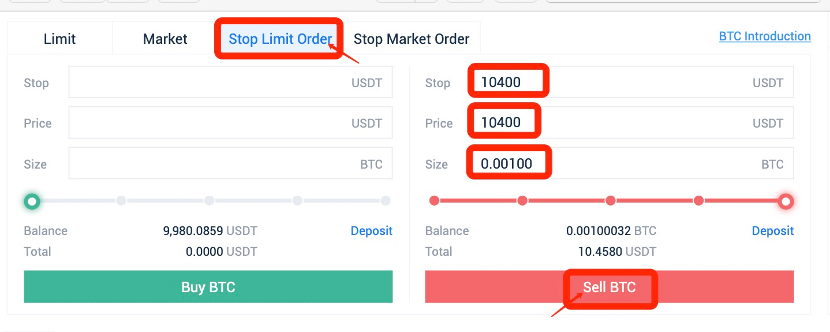

A. Click on [Stop Limit Order].

B. Enter a stop price and an order price. Stop price should be lower than the previous buy price and current price; order price should be ≤ stop price.

C. Click on [Unwind] and [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order.

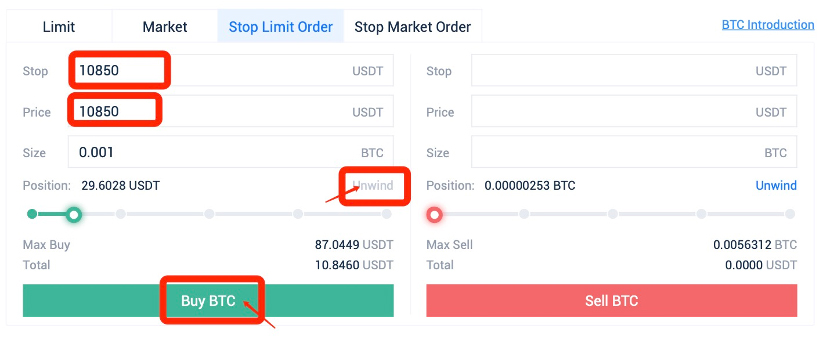

3. Assume your limit sell order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop limit order to buy BTC.

4. Click on [Stop Limit Order]:

A. Enter a stop price and an order price.

B. Stop price should be higher than the previous sell price and current price; order price should be ≥

stop price.

C. Click on [Unwind] and [Buy BTC]. When the stop price is reached, the system will automatically

place and fill the order.

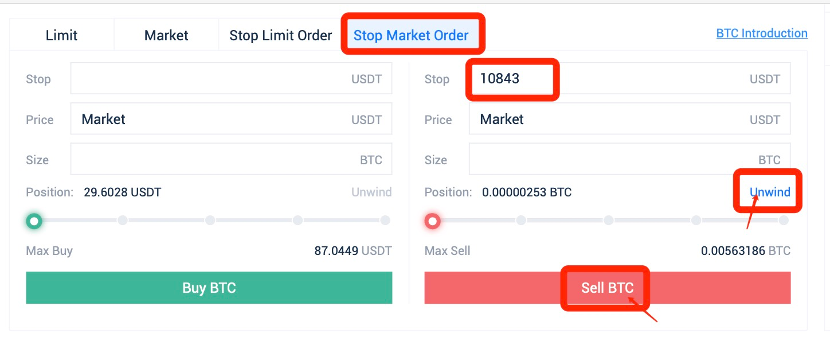

5. Assume your market buy order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop market order to sell BTC.

6. Click on [Stop Market Order]:

A. Enter a stop price.

B. Stop price should be lower than the previous buy price and current price.

C. Click on [Unwind] and [Sell BTC]. When the stop price is reached, the system will automatically place

and fill the order.

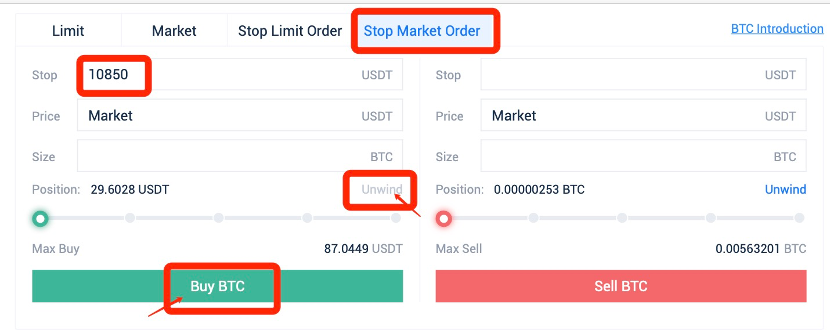

7. Assume your market sell order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop market order to buy BTC.

8. Click on [Stop Market Order]:

A. Enter a stop price.

B. Stop price should be higher than the previous sell price and current price.

C. Click on [Unwind] and [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order.

Notes:

You have already set a stop loss order to mitigate potential losses. However, you want to buy/sell the token before the pre-set stop price is reached, you can always cancel the stop loss order and buy/sell directly.

How to Start Margin Trading on AscendEX 【APP】

2020-09-18

Function Layout of the Margin Trading Page (Professional Version)

2022-01-11

Function Layout of the Margin Trading Page (Standard Version)

2022-01-11

How to Reduce the Risk of Getting Liquidated?

2022-01-06

What is the Reference Price

2021-09-16